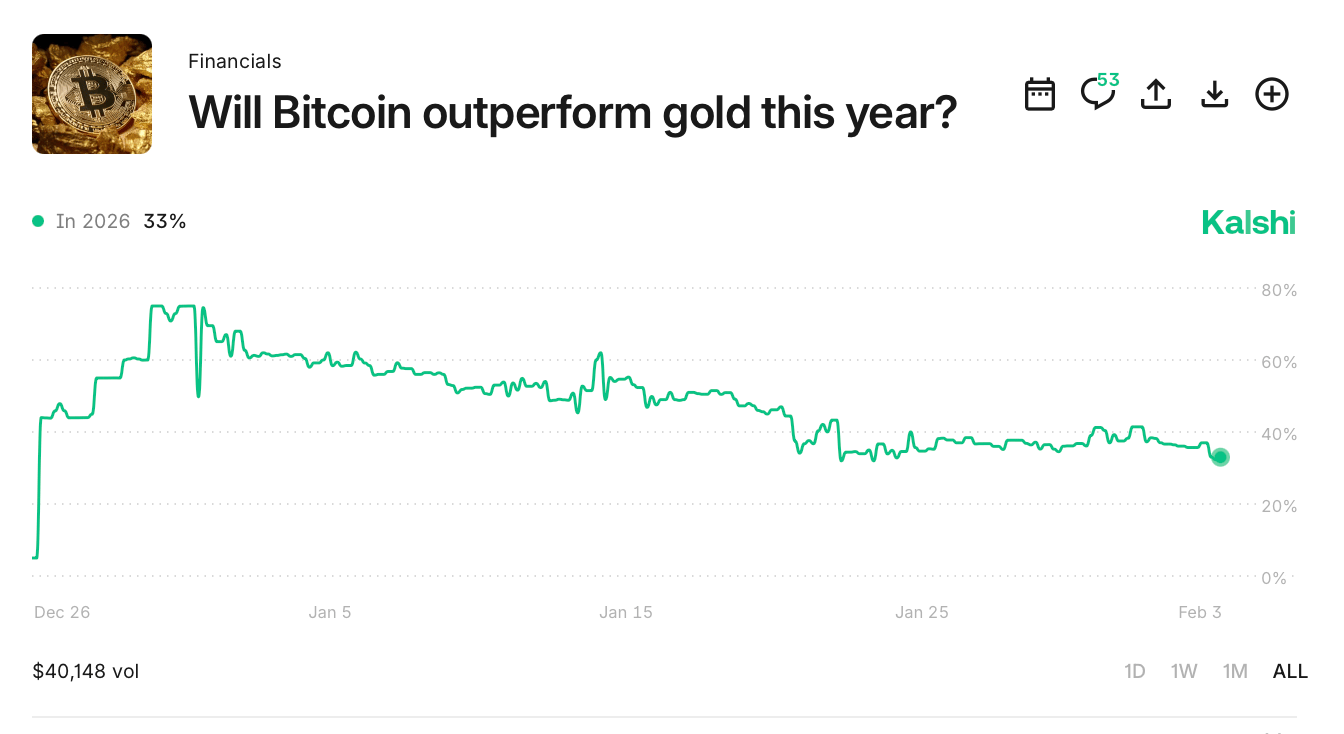

Prediction markets are pricing 67% odds that gold outperforms the world’s most volatile asset in 2026.

Only 33% say BTC wins.

First, define "outperform"…

It’s not about who has the highest peak or the lowest valley during the year.

Or the highest comeback…

It’s whoever has the higher percentage return.

Bitcoin started 2026 around $89,000.

Gold started around $4,350 per ounce.

Whoever has the higher percentage return by December 31st wins.

Example 1:

Bitcoin: $89,000 → $120,000 = +34.8%

Gold: $4,350 → $5,700 = +31.0%

Bitcoin wins

Example 2:

Bitcoin: $89,000 → $80,000 = -10.1%

Gold: $4,350 → $4,150 = -4.6%

Gold wins

It doesn't matter if Bitcoin hits $150,000 in March, then ends the year at $90,000, the calculation is start ($89k) to finish ($90k).

That's it.

It's a straight race. Start to finish. Highest percentage gain wins.

Bitcoin is having a rough year, now trading around $76,000.

Some say it could break $60,000.

It might.

Simultaneously, gold just broke $5,000 per ounce and is sitting around $4,700 and climbing.

So far, gold is winning.

The bad news is it’s still too early.

Unless you think 2-to-1 odds is wrong and BTC has a shot…

The Case for Gold: Safe Haven in a Dangerous Year

Gold is doing what it's supposed to do.

When uncertainty rises, yields stay pinned, dollar tanks, central banks buy, gold grinds higher…

No surprise there.

And of course the biggest banks on Wall Street say gold has room to run.

J.P. Morgan expects $6,300 per ounce by the end of 2026.

Goldman Sachs says $5,400.

UBS says $6,200. Deutsche Bank—$6,000.

They’re likely being conservative.

But is that it?

Zoom out. Consider central bank demand, ETF inflows, and investors hedging against a weakening dollar and geopolitical risk.

One analyst on X said "They're not betting on gold. They're betting against the dollar."

Simlutaneosuly, bitcoin is the last place you want to hedge against a falling dollar.

Bernstein analysts project BTC could bottom around $60,000 in the first half of 2026 before potentially reversing.

There’s a missed pivot down near 46,000 that was expected to hit February 2024.

Point is, the euphoria for BTC is gone. It’s already adapted into “mainstream finance” with ETFs and institutions…

What else can it do? Bitcoin is dead.

If the market resolved today— Gold wins.

Easy 33% gain.

However, don’t count bitcoin out.

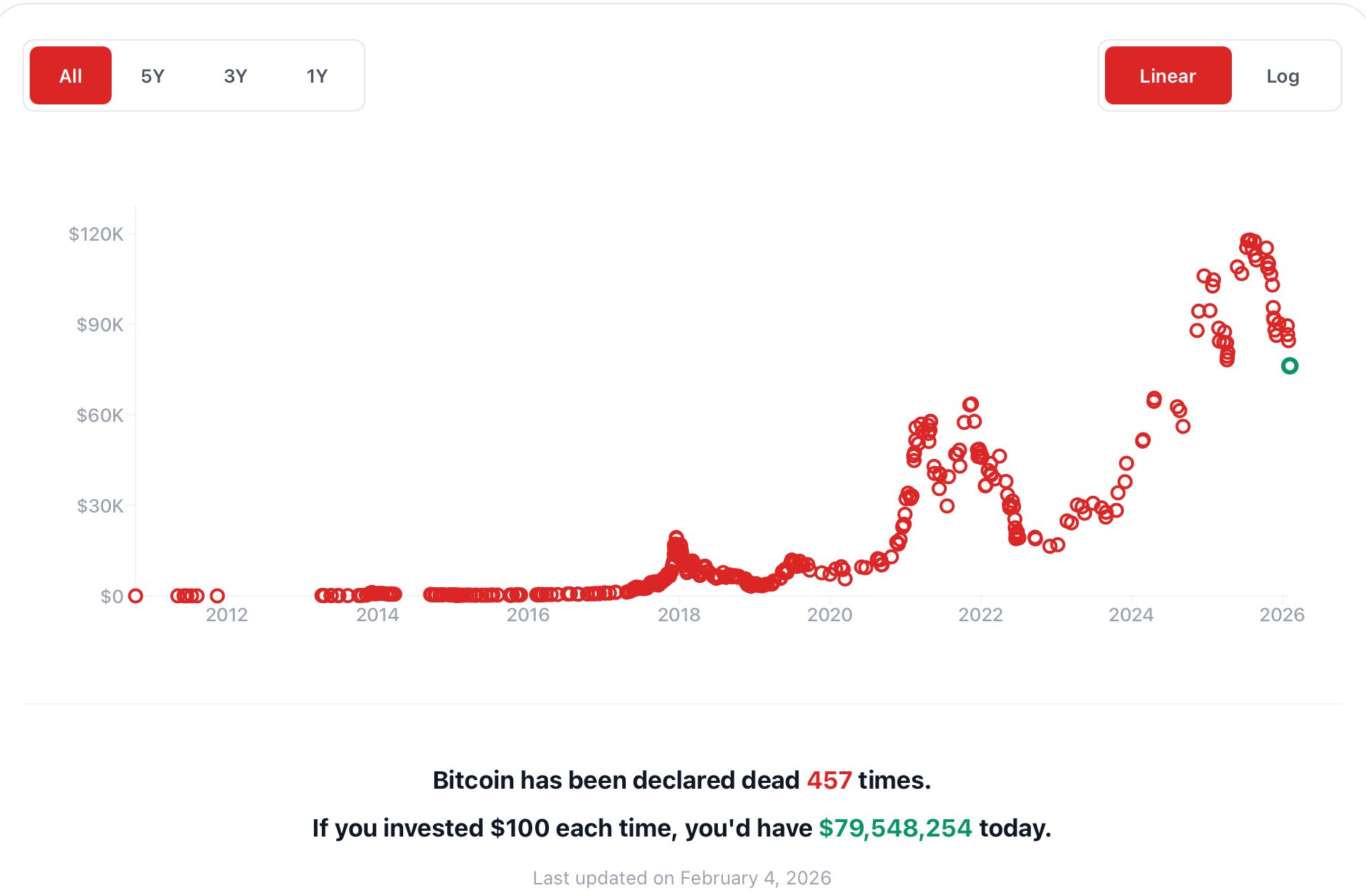

It’s been declared dead 457 times.

And if you invested $100 every time “they” said bitcoin is dead, you’d have $79 thousand dollars…

The Case for Bitcoin — Upside Still Intact

Bitcoin has massively outperformed gold.

We're talking thousands of percent gains versus gold.

Fixed supply. Growing adoption.

Sure, higher risk. But higher reward.

Gold grinds higher, Peter Schiff pounds his chest.

Bitcoin explodes.

Let’s be honest. If someone offers you one ounce of gold or one bitcoin which do you choose?

Even more, and here’s where I’m going with all this...

With the exception of a few states, and a few thousand business in those states, I STILL CAN’T TRANSACT WITH GOLD.

I can’t buy groceries, services, or goods with gold.

But I can with bitcoin.

There’s no hard and fast rule that says if the macro environment shifts from "crisis mode" to "risk-on," then capital doesn’t flee out of bitcoin…

In fact, it’s probably the reverse.

Bitcoin will likely be the FIRST thing to skyrocket in a “s4!T hits the fan” scenario…

Bitcoin is versatile. Volatile yes, but that combination proves bitcoin can surge much faster than gold ever could.

Look, the supply is capped at 21 million coins.

There is no supply cap with gold.

Gold's scarcity is just whatever nature + technology + economics allow at a given time. I can go outside and find gold.

There are cash-for-gold stores in bad neighborhoods.

There aren't cash-for-bitcoin stores.

Now, I'm getting reductive. Borderline absurd. I know.

Point is, the story of gold's "natural scarcity" story is getting old.

We’ve heard it a million times— save haven, store of value...

And it’s all true. Please own gold. I love the gold.

But for the sake of how could we make a trade that could potentially double our money we have to call a spade a spade.

No amount of technology, nuclear, or demand can push Bitcoin supply past 21 million.

Gold is economically scarce, sure. But bitcoin is absolutely scarce.

And with absolutely scarcity bring absolute volatility.

So when sentiment shifts, regardless of what happens in the world, bitcoin has proven it could rip like crazy.

People aren’t ready for gold to go from $4,350 to $6,700.

They’ll lose it. They really will. The euphoria will be incredible.

But that's only 54% gain.

Bitcoin going from $89,000 to $160,000?

That's an 80% gain—nearly double.

And no one will be surprised.

Bitcoin has done this before.

Multiple times. It crashes hard, consolidates. Rips to new highs..

Crashes hard, consolidates.

Rips to new highs again.

A lot can happen between now and December 31st.

It’s not a question of whether Bitcoin can outperform gold.

It's whether 2026 gives it the conditions to do it.

Don’t Miss These Events!

___________________________________________________________________

DISCLAIMER:

The Content is not intended to provide, and does not constitute, financial, investment, trading, tax, legal, or any other form of professional advice. It is not a recommendation, suggestion, solicitation, or offer to buy, sell, trade, or hold any securities, event contracts, derivatives, cryptocurrencies, or other financial instruments on platforms such as Polymarket, Kalshi, or any other prediction market.

Prediction Market Edge believes the Content is reliable but makes no representations or warranties as to its accuracy, completeness, timeliness, or suitability for any purpose. The Content is subject to change without notice, and Prediction Market Edge assumes no duty or obligation to update it.

Trading in prediction markets involves significant risk of loss, including the potential loss of your entire investment. Past performance (including any highlighted “wins” or gains) is not indicative of future results. Markets are volatile, influenced by news, liquidity, resolution rules, and other factors, and individual results will vary. Subscribers and readers should conduct their own independent research, consider their financial situation, risk tolerance, and objectives, and consult qualified professionals before making any trading or investment decisions.

Prediction Market Edge is not responsible for any third-party information, market data, platform rules, or services referenced herein, including but not limited to Polymarket, Kalshi, or other exchanges. Use of the Content is at your own risk.

By subscribing to or accessing this Newsletter or related materials, you agree that Prediction Market Edge and its affiliates shall not be liable for any direct, indirect, incidental, consequential, or other damages arising from your use of the Content.

For important additional information, please review our full Terms of Service, Privacy Policy, and any Subscription Agreement (available on predictionmarketedge.com).