President Trump is apparently interviewing Rick Rieder (BlackRock's Chief Investment Officer for Global Fixed Income) for Federal Reserve Chair this week.

Meanwhile, the previous frontrunners—Kevin Warsh (40%) and Kevin Hassett (39%)—have been locked in a dead heat for weeks. I wrote about that here.

Editorial note ***Written Tuesday morning 13 January when Rick Rieder is pricing in at 7-8%***

But before you go all-in on Ravishing Rick Rieder, you have to ask….

When the President schedules an interview with someone for the most powerful economic position on the planet, should that person really be priced at 8%?

Or is something else going on?

The Context

Jerome Powell's term as Fed Chair ends May 15, 2026, four months away.

If he lasts that long.

Serving grand jury subpoenas to the Fed is unprecedented.

But for now, Powell's not budging.

Regardless, his term expires in May whether he likes it or not.

Ravishing Rick Rieder

Rick Rieder isn't a household name like Powell or Warsh.

But in financial circles he's a boss.

Chief Investment Officer for Global Fixed Income at BlackRock

Oversees trillions in assets (BlackRock manages ~$10 trillion total)

Nearly four decades in the business

Runs the BINC ETF (grew to $14 billion in just a couple years)

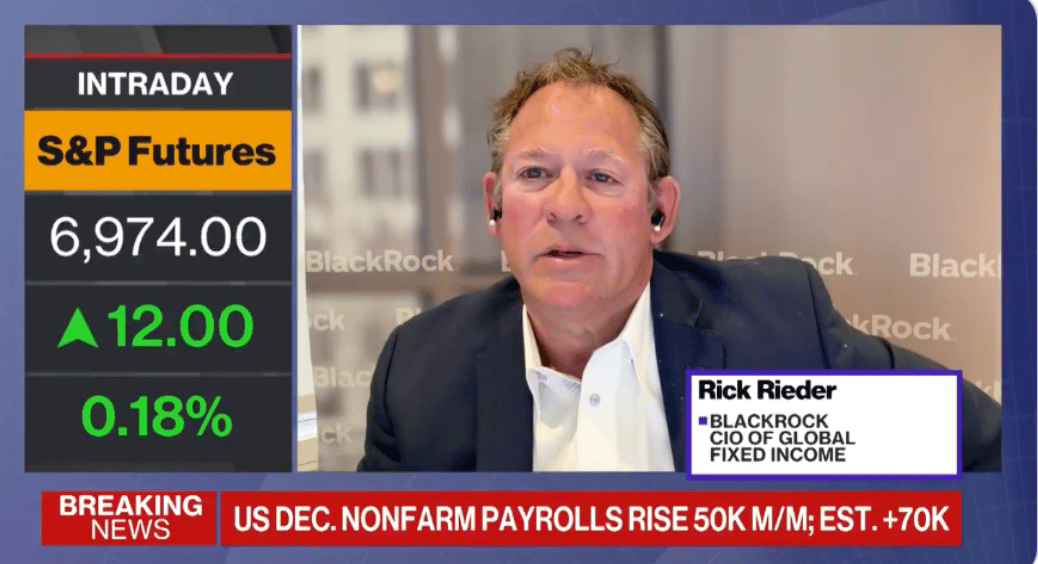

Rick talking December’s employment numbers. (no tie

Here’s Rick on the Meb Faber show.

He's a Wharton guy who's spent decades managing real money and not publishing papers.

He won't fit the mold of the 400 PhDs at the Fed.

But he does appear he could get the job done.

What’s more he’s said this:

"I think the Fed should get the funds rate to 3%. Markets are pricing it. I think we should get there faster.” — Rick Rieder

Exactly what Trump wants.

Or is this a trick from Art of the Deal?

If you believe Trump operates the way he describes in The Art of the Deal—creating leverage, keeping people off-balance, making surprise picks when everyone expects the obvious choice—then would Rieder at 8% would be a slam dunk, or a distraction?

Scenario A: Here's the thing: even if this is a power play, 8% might still be an opportunity.

If Trump is using Rieder for leverage then what happens when the interview goes well?

Suddenly the "power play" becomes a "real option."

That 8% can go to 40%+ real quick.

Scenario B: Trump is creating a decoy to cause Powell to leave before the end of his term. What better way to kick a guy when he’s down than to suggest his replacement is the guy who’s responsible for a Global Income index. Something Powell’s never done before.

Far from over

Either way, this story has a lot of runway. Especially considering central banks chiefs are already pledging loyalty. Trump V. Central Banks 2026 on any ones bingo card?🙋

That’s beside the point.

Last night I picked up a small position—Rieder at 7%.

Not because of the low cost of entry, high upside. Not because the prediction market barely moved after the interview announcement.

But Kevin Hassett is an economist and policy advisor (AEI, Council of Economic Advisers).

Kevin Warsh is kind of a hybrid, ex-Morgan Stanley banker turned Fed Governor.

Rieder is pure buy-side. Rieder knows he can just do things.

Look at Trump's other appointments:

David Sacks (venture capitalist) → AI policy

Elon Musk (entrepreneur) → Government efficiency

Howard Lutnick (Cantor Fitzgerald CEO) → Commerce Secretary

Scott Bessent (hedge fund manager) → Treasury Secretary

Would it really be a surprise to see a buy-side guy running the Fed?

At this point, it'd be more surprising if Trump didn't pick someone with real market experience over another policy guy like Hassett.

Catch These Events

___________________________________________________________________

DISCLAIMER:

The Content is not intended to provide, and does not constitute, financial, investment, trading, tax, legal, or any other form of professional advice. It is not a recommendation, suggestion, solicitation, or offer to buy, sell, trade, or hold any securities, event contracts, derivatives, cryptocurrencies, or other financial instruments on platforms such as Polymarket, Kalshi, or any other prediction market.

Prediction Market Edge believes the Content is reliable but makes no representations or warranties as to its accuracy, completeness, timeliness, or suitability for any purpose. The Content is subject to change without notice, and Prediction Market Edge assumes no duty or obligation to update it.

Trading in prediction markets involves significant risk of loss, including the potential loss of your entire investment. Past performance (including any highlighted “wins” or gains) is not indicative of future results. Markets are volatile, influenced by news, liquidity, resolution rules, and other factors, and individual results will vary. Subscribers and readers should conduct their own independent research, consider their financial situation, risk tolerance, and objectives, and consult qualified professionals before making any trading or investment decisions.

Prediction Market Edge is not responsible for any third-party information, market data, platform rules, or services referenced herein, including but not limited to Polymarket, Kalshi, or other exchanges. Use of the Content is at your own risk.

By subscribing to or accessing this Newsletter or related materials, you agree that Prediction Market Edge and its affiliates shall not be liable for any direct, indirect, incidental, consequential, or other damages arising from your use of the Content.

For important additional information, please review our full Terms of Service, Privacy Policy, and any Subscription Agreement (available on predictionmarketedge.com).