Prediction markets are pricing a 41% chance the United States strikes Iran by March 31st.

Up from 22%, nearly DOUBLE from just weeks ago.

Include $194 million in total volume and things are getting pretty serious.

So Far Talks Have Failed…

The US and Iran have been trying to reach an amicable, diplomatic solution.

Washington wants a broad deal covering Iran's nuclear program, ballistic missiles, support for armed groups, and fair treatment of Iranian citizens.

Tehran insists on focusing exclusively on the nuclear program and wants recognition of its right to enrich uranium.

It’s not working out.

Iran continues enriching uranium and the US wants limits first…

Classic standoff.

Remember, we’re talking about strikes, not whether or not Khamenei would be ousted like we did a few days back…

Strikes.

As the rules on Polymarket dictate, if the US initiate's a drone, missile, or air strike on Iranian soil or any official Iranian embassy or consulate.

Regardless…

Something Is Happening

Here’s why…

1. The Pentagon Pizza Tracker Is Firing

If you're not familiar with Pentagon Pizza Watch, here's the concept: when pizza orders to Pentagon-area restaurants spike dramatically, it often correlates with major military operations being planned or executed. “Late nights at the office”.

Saturday, February 7, 2026:

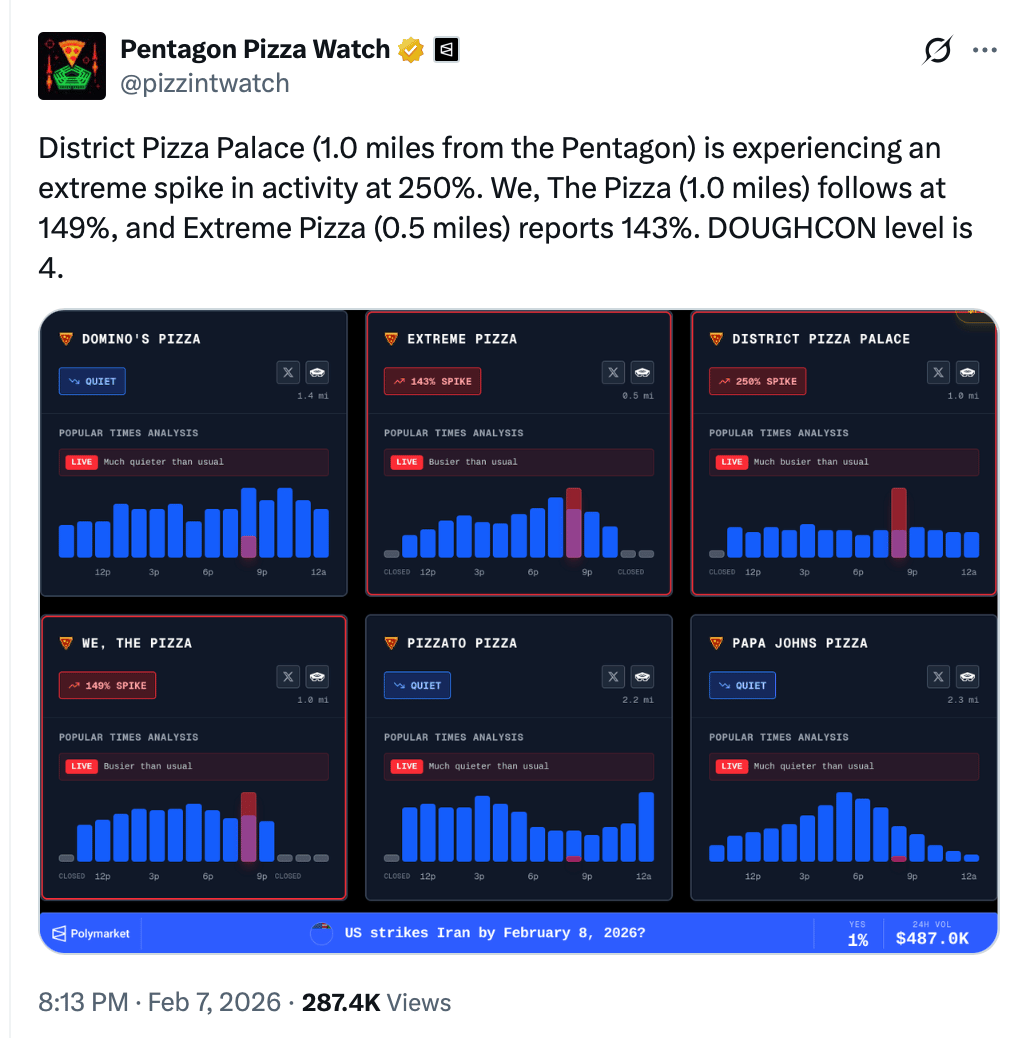

District Pizza Palace (1.0 miles from Pentagon): 250% spike in activity

We, The Pizza (1.0 miles): 149% spike

Extreme Pizza (0.5 miles): 143% spike

DOUGHCON level: 4.

Something tells me this isn’t a weekend long super bowl watch party.

If that wasn’t enough…

2. F-22 Raptors Pulled from Super Bowl Flyover

On February 7th, the US Air Force pulled F-22 Raptors from the planned Super Bowl flyover, citing "operational assignment.".

Of course, social media lit up with speculation:

"Trump bombing Iran during the Super Bowl halftime show so NBC is forced to cut away from Bad Bunny might be the funniest thing he could possibly do."

That’d be typical “Trump” thing to do.

Insert himself in the global conversation, mid-Super Bowl and interrupt the halftime show, or any other global event with a “special announcement”... "

Anyway, since the military would need more than a handful of F22s…

3. 112 C-17 Globemasters Heading to the Middle East

Open-source flight tracking data shows 112 US Air Force C-17 Globemaster cargo planes either in or en route to the Middle East and Europe.

One regional analyst. Buzz Paterson, said "112 C-17s are in or on their way to the Middle East. Guys, that's a lot. Like Desert Storm a lot. Stay tuned."

For context, C-17s can carry up to 170,000 pounds of cargo each. That's troops, equipment, ammunition, or medical supplies for a sustained military operation.

ONE HUNDRED AND TWELVE?!

He wasn’t alone: US Air Force C-17s and C-5M transport aircraft landed at an undisclosed airfield in Turkmenistan—right on Iran's northeastern border.

4. US Embassy: "Leave Iran NOW"

On Friday, the US State Department issued an emergency security alert:

"Leave Iran now. Have a plan for departing Iran that does not rely on U.S. government help."

The alert warned of road closures, internet blockages, flight cancellations, and more…

"Find a secure location within your residence or another safe building. Have a supply of food, water, medications, and other essential items."

Yikes.

The History: This Isn't New

Trump and Iran have a long history.

In January 2020: A US drone strike killed Qasem Soleimani, a top Iranian general, in Baghdad.

Even so, it seems like Trump is playing for keeps this time around…

Remember what happened to Maduro?

Anyway, it could be a long couple of weeks in the Middle East.

Or if it's anything like Venezuela, it could be over in a couple of hours.

(Though it's not Venezuela. The terrain, the capability, the geopolitical stakes are all different.)

Point is, preparation for a regional war takes time.

It's hard to look at 100+ military aircraft heading to the Middle East and think this is just posturing.

You think we weren't over there building the runways, hangars, and all the infrastructure needed for show and tell?

Oh, and for what it’s worth, February 11th is the 47th anniversary of the Iranian revolution.

I didn't realize that until I was doing research for this post.

Interesting timing isn’t it?

So Is An Attack Imminent?

Sure looks like it…

Pentagon pizza orders spiking 250%. F-22s pulled from the Super Bowl. 112 C-17s heading to the Middle East. US embassy saying "leave now."

Markets are pricing 41% by March 31st, 22% by February 28th.

All this begs the question: what would happen with oil?

Well, if a strike happens, oil probably spikes. Right?

WTI crude is at $63 right now. A regional conflict could push it to $70+, maybe higher. Depending on how Iran retaliates and whether the Strait of Hormuz gets involved.

And if that's the case, then the prediction markets should price that in as well…

Or are they?

Here's what Polymarket is saying about oil by end of February:

$60: 64% odds (most likely)

$66: 61% odds

$68: 58% odds

$70: 37% odds

$80: 8% odds

Wait, are they suggesting oil stays flat by end of February.

Only 37% chance it hits $70, and 8% chance it hits $80.

This is interesting because:

US strike Iran by Feb 28: 22% odds

Oil hits $70 by Feb 28: 37% odds

The arbitrage question: If you think the Iran strike odds are underpriced at 22%, is oil >$70 at 37% also underpriced?

Or is the market saying: Even if there's a strike, oil might not spike that high—short-lived conflict, limited scope, markets already pricing it in?

Stay tuned. Tomorrow we'll dig a little deeper and see what kind of trade we can make out of this…

Happy Monday.

Don’t Miss These Events!

___________________________________________________________________

DISCLAIMER:

The Content is not intended to provide, and does not constitute, financial, investment, trading, tax, legal, or any other form of professional advice. It is not a recommendation, suggestion, solicitation, or offer to buy, sell, trade, or hold any securities, event contracts, derivatives, cryptocurrencies, or other financial instruments on platforms such as Polymarket, Kalshi, or any other prediction market.

Prediction Market Edge believes the Content is reliable but makes no representations or warranties as to its accuracy, completeness, timeliness, or suitability for any purpose. The Content is subject to change without notice, and Prediction Market Edge assumes no duty or obligation to update it.

Trading in prediction markets involves significant risk of loss, including the potential loss of your entire investment. Past performance (including any highlighted “wins” or gains) is not indicative of future results. Markets are volatile, influenced by news, liquidity, resolution rules, and other factors, and individual results will vary. Subscribers and readers should conduct their own independent research, consider their financial situation, risk tolerance, and objectives, and consult qualified professionals before making any trading or investment decisions.

Prediction Market Edge is not responsible for any third-party information, market data, platform rules, or services referenced herein, including but not limited to Polymarket, Kalshi, or other exchanges. Use of the Content is at your own risk.

By subscribing to or accessing this Newsletter or related materials, you agree that Prediction Market Edge and its affiliates shall not be liable for any direct, indirect, incidental, consequential, or other damages arising from your use of the Content.

For important additional information, please review our full Terms of Service, Privacy Policy, and any Subscription Agreement (available on predictionmarketedge.com).