Last week, we made the case it would be hard for gas prices to come in above $2.812.

We were right. Gas came in at $2.796, and if you traded the “No” contracts, you locked in roughly a 40% payout.

Not bad for trading inside a seven-tenths-of-a-cent margin.

Catch up here: [Link: Could US Gas Prices Hit Above 2.812 This Week?]

But this week the gas situation is a little different…

Now we're asking the same question again, just with a slightly higher threshold: Will gas prices come in above $2.830 by January 19th?

Let’s take a look at how things are setting up.

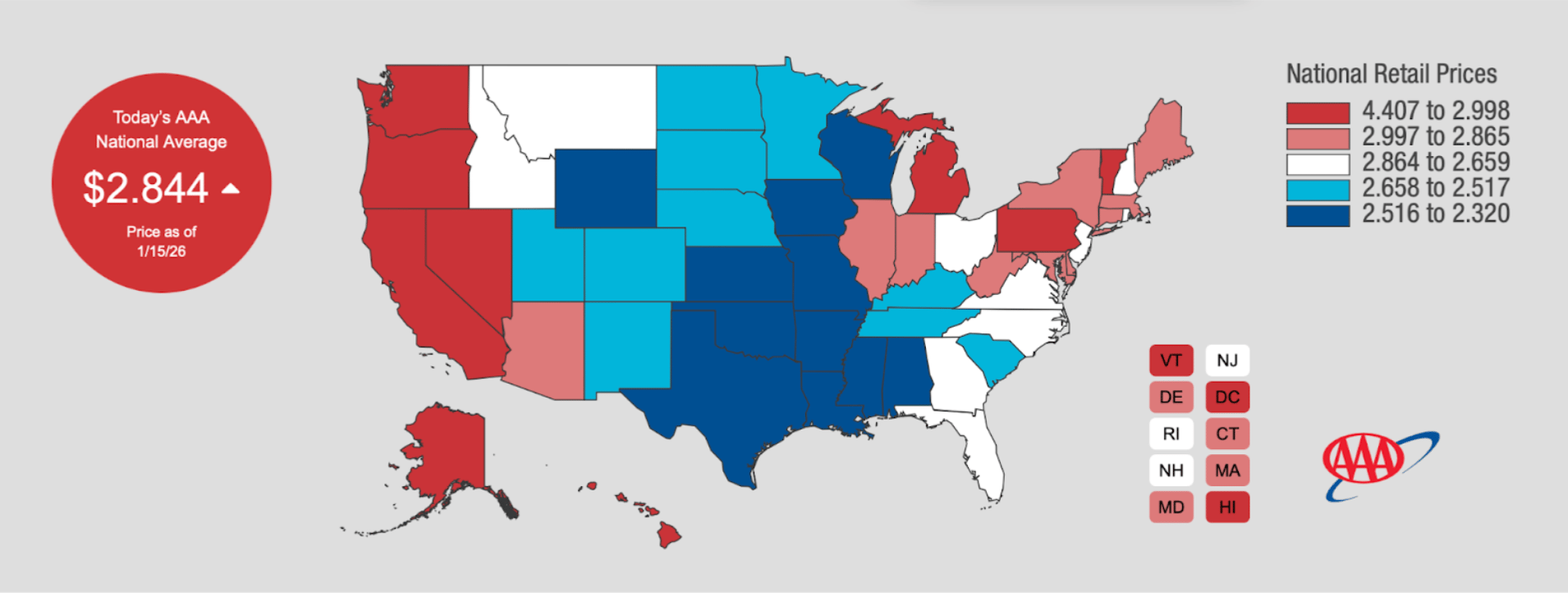

Yesterday the national average was $2.844

Today, as of 16 January, the national average sits at $2.839 right now.

Less than one cent of breathing room.

We’re right about at the threshold.

So it’s going to be tough.

But let’s zoom out and look at the big picture.

History says it could keep going…

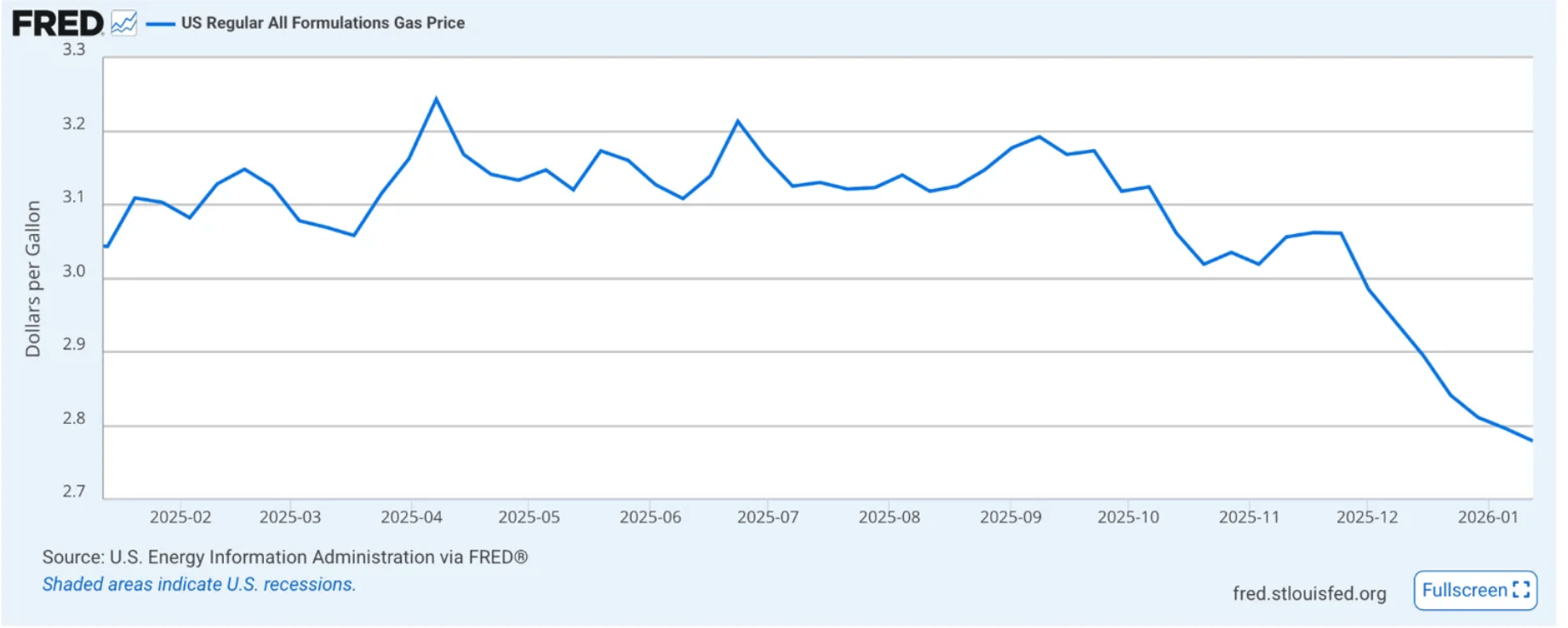

Looking at the past year from FRED data, the trend is clear.

Gas prices hovering over $3.00 until November when they began their relentless slide through December and into January.

We're essentially back to price levels last seen in early 2021.

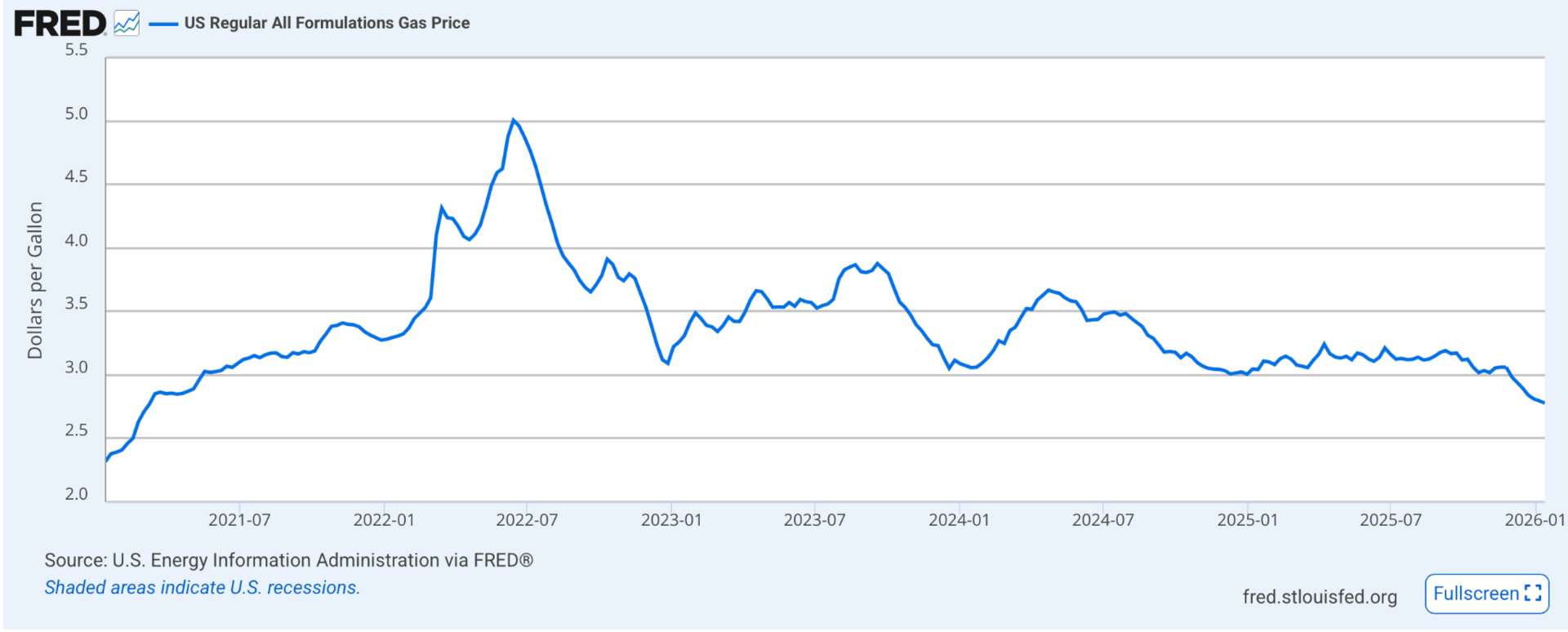

5 year chart for reference.

But will gas prices keep falling? or are we done?

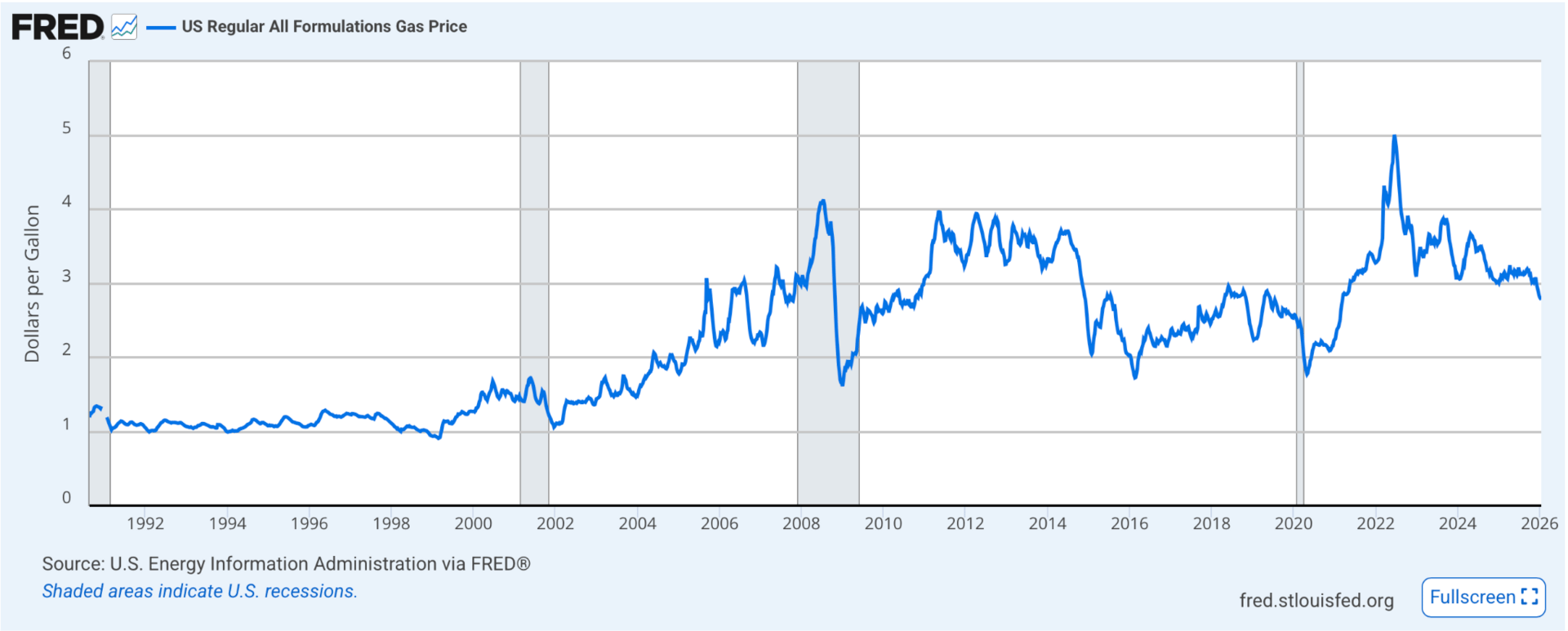

Remember, since 1992, gas prices have spent roughly a third of the time below $2 per gallon.

We're not far off at $2.839.

Only 84 cents above the $2 threshold.

Sure, it’s easy to look at the chart since 1992 and assume gas can't fall much further because 'everything's more expensive than the 90s.'

But don't let nostalgia fool you. Adjusted for inflation, we're already back to early-1990s pricing. There's absolutely no floor preventing further declines.

All that to say, the downtrend might not be over. That one penny could easily give way.

We’re right on the cusp. Which actually supports the bear case, that trading the"No" contracts on whether or not gas prices come in above $2.830 might be the right play.

But will they?

Until next week.

-Prediction Market Edge

Catch These Events

___________________________________________________________________

Risk Disclosure: The Content is not intended to provide, and does not constitute, financial, investment, trading, tax, legal, or any other form of professional advice. It is not a recommendation, suggestion, solicitation, or offer to buy, sell, trade, or hold any securities, event contracts, derivatives, cryptocurrencies, or other financial instruments on platforms such as Polymarket, Kalshi, or any other prediction market.

Prediction Market Edge believes the Content is reliable but makes no representations or warranties as to its accuracy, completeness, timeliness, or suitability for any purpose. The Content is subject to change without notice, and Prediction Market Edge assumes no duty or obligation to update it.

Trading in prediction markets involves significant risk of loss, including the potential loss of your entire investment. Past performance (including any highlighted “wins” or gains) is not indicative of future results. Markets are volatile, influenced by news, liquidity, resolution rules, and other factors, and individual results will vary. Subscribers and readers should conduct their own independent research, consider their financial situation, risk tolerance, and objectives, and consult qualified professionals before making any trading or investment decisions.

Prediction Market Edge is not responsible for any third-party information, market data, platform rules, or services referenced herein, including but not limited to Polymarket, Kalshi, or other exchanges. Use of the Content is at your own risk.

By subscribing to or accessing this Newsletter or related materials, you agree that Prediction Market Edge and its affiliates shall not be liable for any direct, indirect, incidental, consequential, or other damages arising from your use of the Content.

For important additional information, please review our full Terms of Service, Privacy Policy, and any Subscription Agreement (available on predictionmarketedge.com).