Gas prices have been in a dramatic freefall since Thanksgiving, plunging to levels not seen in nearly five years.

But after weeks of relentless decline, prediction markets hint we’re at the bottom, and prices could tick back up this week.

However, the national average for regular gas is $2.819. With Kalshi’s cutoff set at $2.812, the entire market hinges on a price discrepancy of just $0.007 — seven-tenths of one cent.

That means, this isn't a trade on a major move in energy prices.

It’s a question of whether gas prices can stay barely above a rounding error.

By looking at a couple charts and a few key fundamentals, let’s see whether there’s a trade worth putting together.

At the time of writing, the market is nearly divided…

Let’s look at the charts.

This chart uses data from AAA Fuel Prices, showing national retail gasoline averages as of January 8, 2026.

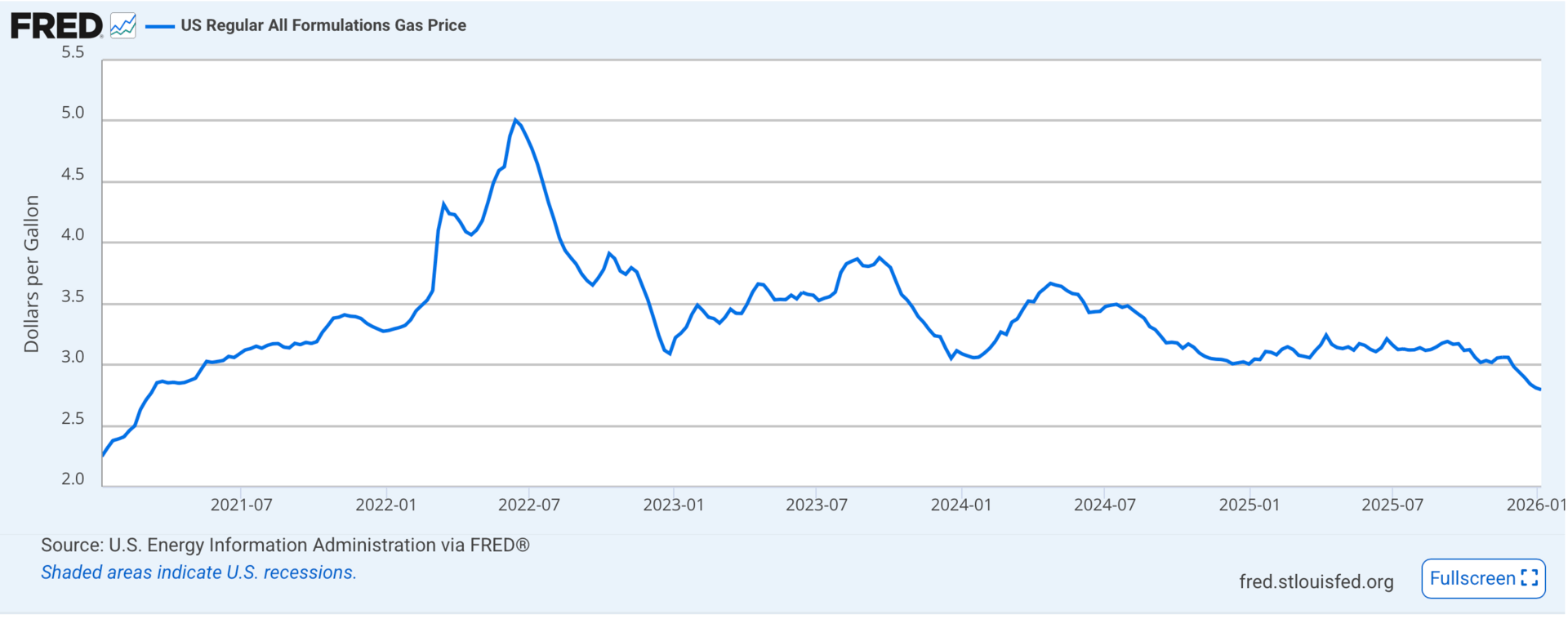

Data from the U.S. Energy Information Administration via FRED® shows that gas prices dropped from $3.06 per gallon on November 24th….

To $2.79 by late December.

Looking at weekly data from FRED, the trend is unmistakable.

U.S. gas prices have declined steadily at the end of each week — from $3.06 on November 24 to $2.98, $2.94, $2.90, $2.84, $2.81…

That’s a total decline of about 26 cents in six weeks. 4.3 cents per week.

With an average weekly decline of about 4 cents, the remaining move required for this market to resolve is less than one-fifth of a typical week’s drop.

So you have to ask, wth gas prices falling an average of 4.3 cents per week, will they slip one more cent this week?

If gas prices have been falling more than four cents a week, isn’t it reasonable to ask why that trend would suddenly stall less than one penny above the line?

If the recent average rate of decline continued, you’d expect something closer to the high $2.70s, right?

What’s the mechanism that stops it here? What’s the case for that decline stopping seven-tenths of a cent above the cutoff?

Anyway, in case you're interested, here’s where gas prices fell the last five years. $3 seems like a key level.

The exact figures differ slightly from AAA’s daily national average, but the direction is the same: a persistent, multi-week downtrend.

With the national average hovering just pennies above the cutoff, the question isn’t whether prices collapse further, but whether they simply stop falling.

Where Gas Prices Stand: The Sentiment is Divided

The political and public commentary on social media reflects both celebration and frustration, depending on where you live.

The department of Energy released this chart saying:

They go on to say that thanks to President Trump, Americans are now paying less at the pump, and gas prices keep falling nationwide.

Senator Joni Ernst posted a photo from Des Moines, Iowa, showing gas at $1.89 per gallon, thanking President Trump.

But not everyone is celebrating.

One X user, @lalovestrump, highlighted the stark regional divide, noting that California residents are "getting so screwed" with prices remaining stubbornly above $4.50 due to state taxes and regulations.

Granted, this regional divide might be the wild card for the national average.

But while the headlines trumpet record lows, you have to realize market sentiment and actual price movement are two different things.

That’s what makes this an interesting prediction market setup. It’s not a bet on energy policy or a macro call on oil…

Sometimes the cleanest trades aren’t about big moves, they’re about knowing how little needs to happen.

Catch Up Here:

___________________________________________________________________

DISCLAIMER:

The Content is not intended to provide, and does not constitute, financial, investment, trading, tax, legal, or any other form of professional advice. It is not a recommendation, suggestion, solicitation, or offer to buy, sell, trade, or hold any securities, event contracts, derivatives, cryptocurrencies, or other financial instruments on platforms such as Polymarket, Kalshi, or any other prediction market.

Prediction Market Edge believes the Content is reliable but makes no representations or warranties as to its accuracy, completeness, timeliness, or suitability for any purpose. The Content is subject to change without notice, and Prediction Market Edge assumes no duty or obligation to update it.

Trading in prediction markets involves significant risk of loss, including the potential loss of your entire investment. Past performance (including any highlighted “wins” or gains) is not indicative of future results. Markets are volatile, influenced by news, liquidity, resolution rules, and other factors, and individual results will vary. Subscribers and readers should conduct their own independent research, consider their financial situation, risk tolerance, and objectives, and consult qualified professionals before making any trading or investment decisions.

Prediction Market Edge is not responsible for any third-party information, market data, platform rules, or services referenced herein, including but not limited to Polymarket, Kalshi, or other exchanges. Use of the Content is at your own risk.

By subscribing to or accessing this Newsletter or related materials, you agree that Prediction Market Edge and its affiliates shall not be liable for any direct, indirect, incidental, consequential, or other damages arising from your use of the Content.

For important additional information, please review our full Terms of Service, Privacy Policy, and any Subscription Agreement (available on predictionmarketedge.com).