PayPal reports Q4 FY2025 earnings tomorrow morning, February 3, 2026 at 8:00 AM EST.

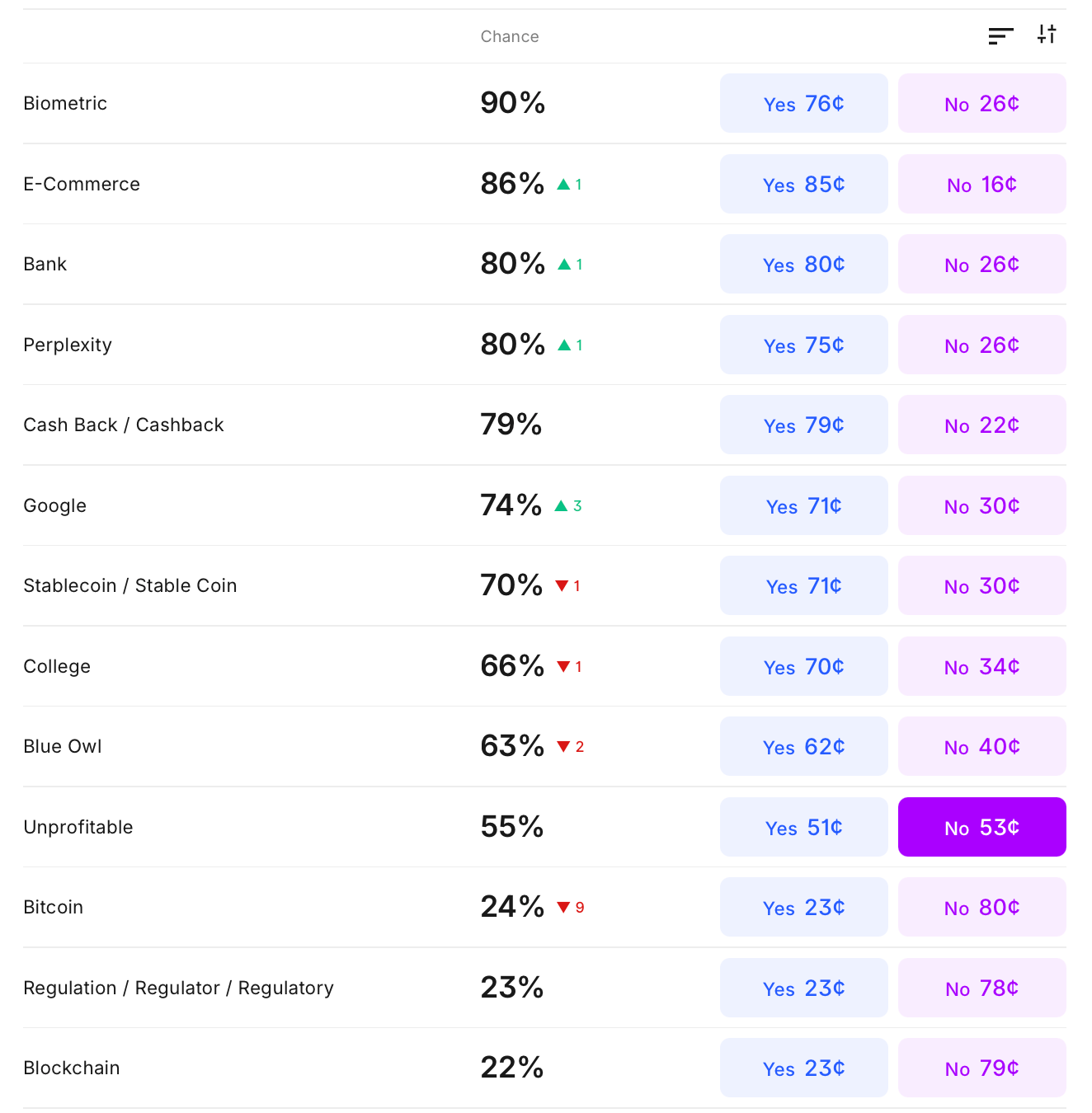

While prediction markets are pricing "Biometric" at 90%, "Perplexity" at 80%, and "Bitcoin" at 24%, I analyzed three consecutive quarters of PayPal's earnings transcripts word-by-word to see what CEO Alex Chriss and CFO Jamie Miller actually talk about when reporting to investors.

First thing to be aware of is this: Bitcoin has never been mentioned.

Not once. Not ever.

Who’s buying these 24 cent YES contracts?

I don’t know, but there’s another elephant in the room that might force a few yes’s….

PayPal stock is down 29% from its 52-week high, trading at $55.51.

Three analyst downgrades hit in the last month alone, including Rothschild Redburn slashing their price target from $70 to $50 with a rare "Sell" rating.

The thesis being the Marginal consumer is under pressure."

Morgan Stanley and Daiwa piled on with their own cuts in December.

That means this call might mean more for Paypal than the prediction markets.

They need to come out guns blazing. Shouting making money hand over fist.

That involves every initiative, strategy, major push, partnerships

And hopefully, increase mentions…

Here are the words on deck:

🚨 Breaking Context: What's Changed Since Q3

1. The Perplexity Free Year Announcement (3 Weeks Ago)

PayPal and Venmo just announced they're giving all users free one-year access to Perplexity Pro (normally $200/year). This is a massive consumer acquisition play tied to their agentic AI strategy. Expect Alex to tout this partnership heavily today as proof of their AI leadership.

2. Alex Chriss on Stablecoins (2 Weeks Ago via LinkedIn)

"Stablecoin within PayPal is a key priority. It's being led by me. I'm making sure that crypto is top of mind and something that we're investing in as a company."

PYUSD grew from $500M in January 2025 to nearly $4B by December 2025 (8x growth). PayPal is paying out 4% on PYUSD balances to drive adoption.

The real prize isn't issuance—it's transaction volume.

B2B and B2C stablecoin payments are growing at 140% annualized vs. traditional fintech payments at 21.4% CAGR.

Yet, Alex's public commitment, stablecoin mentions collapsed 9→4→1 across Q1→Q3. (See the Mention SuperMeter below)…

3. College Partnerships Expanding

Big Ten and Big 12 deals (announced June 2025) are now live.

Athletic departments are using PayPal for institutional payments to student-athletes.

Beyond sports, PayPal is becoming the default payment method for college tuition, textbooks, and campus spending. Venmo debit cards are specifically marketed to college students. This is a demographic play for Gen Z habituation.

4. Biometrics = Passkeys Rollout

PayPal just launched Passkeys for biometric login on Apple and Google devices. This is the tech behind the "2% to 5% conversion improvement" they touted in Q3. They're also using facial biometric identity verification (scan your driver's license) for CIP (Customer Identification Program) compliance. Not creepy at all.

🎯 What This Data Actually Tells Us About Q4 FY2025

Biometrics doubled from Q1 (2 mentions) to Q3 (4 mentions), becoming PayPal's new checkout conversion strategy.

With Passkeys now live and facial biometric verification in production, expect this to dominate the checkout discussion.

In Q3, management said: "We are focused on scaling biometric login, including passkeys... authentication efforts have shown improved conversion between 2% to 5%." Not creepy at all.

E-Commerce: PayPal positions itself as an "e-commerce and digital payments leader" when talking to investors.

They use "online commerce," "digital commerce," and "global commerce" interchangeably.

The word appears every quarter as a core business descriptor when discussing macro trends, consumer spending, or branded checkout volume growth. With analyst concerns about the "marginal consumer," expect macro e-commerce commentary.

Bank: Management routinely discusses "banks," "bank partners," "bank accounts," and "online banking" when describing funding sources and partnerships.

Germany's wallet is repeatedly called "bank-connected," and infrastructure discussions always reference bank connectivity. This appears in every prepared remarks section. No reason for Q4 to break the pattern.

Cashback / Cash Back : In Q1, they leaned hard into making PayPal "the most rewarding way for consumers to pay," talking about "putting more money back in consumers' pockets."

This shows up in discussions of the PayPal Cashback Mastercard, debit card rewards programs, and competitive value propositions.

With consumer spending under pressure, expect Alex to lean into the rewards narrative as a retention/acquisition tool.

Again, Perplexity first appeared in Q2 when discussing "agentic commerce with Perplexity, Anthropic, and Salesforce." Q3 referenced "our partnership with Perplexity earlier this year."

But the game changed 3 weeks ago when PayPal announced free one-year Perplexity Pro for all users.

This is a $200/year value being given to hundreds of millions of users. Expect Alex to frame this as a major consumer acquisition win and proof of AI leadership. This could be one of the headline announcements of the call.

Google appeared in Q3 with the announcement of a "multi-year partnership with Google to create new AI shopping experiences."

Likely mentioned this quarter alongside OpenAI and Perplexity in agentic commerce discussions as part of PayPal's AI partnership portfolio.

These partnerships are the "future-proofing" narrative Alex needs to offset analyst concerns about core business growth.

You wanna see something sweet?

Started at 9 mentions in Q1 during PYUSD launch hype, dropped to 4 in Q2, and collapsed to just 1 mention in Q3...

Alex publicly committed 2 weeks ago: "Stablecoin within PayPal is a key priority. It's being led by me." PYUSD grew 8x in 2025 ($500M→$4B). Stablecoin payments are growing at 140% annualized.

Gotta talk about it, right? It’s a priority. Let’s get a progress update Alex, chop chop.

College spiked to 3 mentions in Q2 with the "Big 12 and Big 10 college distribution deals" announcement. Q3 had a single mention: "college partnerships drove 1 million FTUs."

But the partnerships are now live and expanding beyond sports. PayPal is becoming the default campus payment method (tuition, textbooks, concessions, merchandise).

Venmo debit cards are marketed specifically to college students. This is a Gen Z demographic play, and with Venmo revenue growing 20%+, I wouldn’t put it past Alex to highlight college as a driver of that growth.

Blue Owl first appeared in Q3 with the announcement of "externalizing a portion of short-term U.S. pay later receivables with Blue Owl Capital." Likely discussed when covering BNPL financials or credit externalization strategy as part of their balance sheet-light model. With BNPL volume growing 20%+ quarterly, this partnership supports the growth story.

Unprofitable ppears sporadically only when discussing Braintree repricing strategy. The current story is all about "profitable growth" and pruning low-margin volumes. They do refer to lower-quality business, but the literal word "unprofitable" competes with synonyms like "non-profitable" and "loss-making." With analyst downgrades citing "marginal consumer under pressure," Alex might lean into "we're shedding unprofitable volume" as a defense.

Could spike higher than usual.

Never mentioned across three consecutive quarters, bitcoin could be a major upset.. Or letdown.

PayPal says "crypto," "digital currencies," or "crypto users" instead. Recent earnings are dominated by margins, PayPal World, and PYUSD discussions.

Explicit "Bitcoin" mentions would only spike if crypto activity becomes front-page news again—this is more a macro/crypto-cycle bet than something structurally present in earnings calls.

Even with Alex's recent stablecoin comments, he never said "Bitcoin." He said "crypto" and "stablecoin." The word Bitcoin will not appear.

The word regulation has a shot but man it’s a long one.

In Q1, they mentioned "favorable connection with regulator in U.K." when discussing biometrics two-factor authentication approval.

But it’s not the word we want now is it….

Do you see the problem? The word ‘regulator’won’t cut it.

Paypal talked about "the regulatory environment," "compliance," and "working with regulators" (especially around PYUSD and cross-border).

The concept is present, but the literal word is nowhere to be found!

What are the odds there will be a 50/50 split.

Half YES’s and the other half NO’s tomorrow.

Good luck tomorrow morning.

Don’t Miss These Events!

___________________________________________________________________

DISCLAIMER:

The Content is not intended to provide, and does not constitute, financial, investment, trading, tax, legal, or any other form of professional advice. It is not a recommendation, suggestion, solicitation, or offer to buy, sell, trade, or hold any securities, event contracts, derivatives, cryptocurrencies, or other financial instruments on platforms such as Polymarket, Kalshi, or any other prediction market.

Prediction Market Edge believes the Content is reliable but makes no representations or warranties as to its accuracy, completeness, timeliness, or suitability for any purpose. The Content is subject to change without notice, and Prediction Market Edge assumes no duty or obligation to update it.

Trading in prediction markets involves significant risk of loss, including the potential loss of your entire investment. Past performance (including any highlighted “wins” or gains) is not indicative of future results. Markets are volatile, influenced by news, liquidity, resolution rules, and other factors, and individual results will vary. Subscribers and readers should conduct their own independent research, consider their financial situation, risk tolerance, and objectives, and consult qualified professionals before making any trading or investment decisions.

Prediction Market Edge is not responsible for any third-party information, market data, platform rules, or services referenced herein, including but not limited to Polymarket, Kalshi, or other exchanges. Use of the Content is at your own risk.

By subscribing to or accessing this Newsletter or related materials, you agree that Prediction Market Edge and its affiliates shall not be liable for any direct, indirect, incidental, consequential, or other damages arising from your use of the Content.

For important additional information, please review our full Terms of Service, Privacy Policy, and any Subscription Agreement (available on predictionmarketedge.com).