How about this timing:

Yesterday a verified X account asked, “what's the chance tomorrow afternoon there is news of another bank failure?"

You might say, "Another? There's already been one?"

Yep.

First Bank Failure of 2026

Metropolitan Capital Bank & Trust of Chicago, Illinois was closed by the Illinois Department of Financial and Professional Regulation on January 30, 2026.

The FDIC stepped in as receiver.

First Independence Bank of Detroit assumed substantially all deposits and most of the assets.

The bank had about $261 million in assets and $212 million in deposits.

It was quiet. No panic. No headlines (not really). The FDIC did what it always does—orchestrated a takeover, protected depositors, and moved on.

No one noticed.

Except the prediction markets…

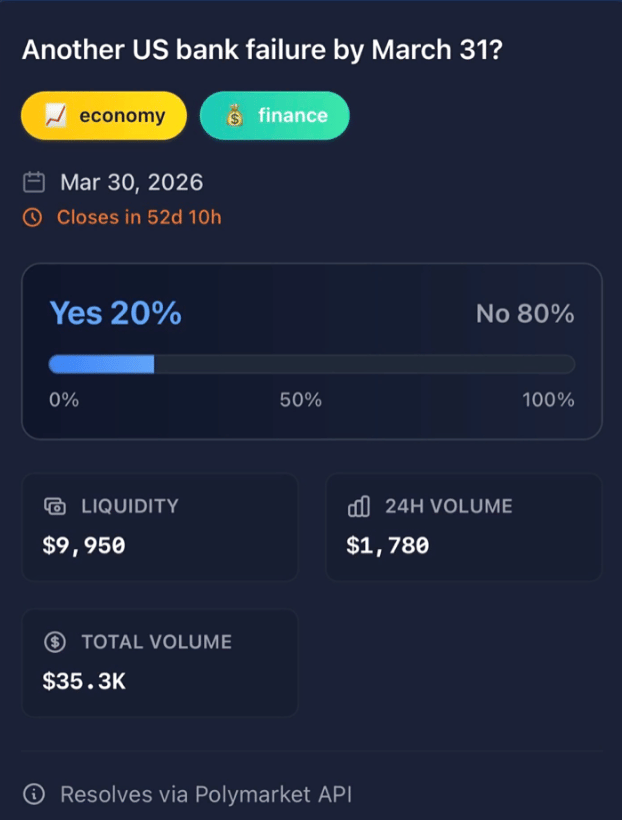

And right now, they're pricing an 20% chance there's another US bank failure before March 31st.

(NOTE: There's another market for bank failure ending February 28, -the odds are similar. So by looking at end of March, it gives us an extra four weeks for the potential trade/thesis to work out.)

When People Think "Bank Failure," They Think Big

Here’s a list of the biggest 8 bank failures in modern time.

But most bank failures aren't like that.

You never hear of it.

Metropolitan Capital Bank & Trust had $261 million in assets.

That's 0.08% the size of Washington Mutual. Merely a flesh wound.

Small, regional institutions that get swallowed by the FDIC without anyone noticing.

The highest number of U.S. bank failures in a single year was 1930, when about 1,350 banks suspended operations during the early phase of the Great Depression.

Insane. Between 1930 and 1933, over 9,000 banks failed.

Sidebar: a great book about that era is The Great Depression: A Diary by Benjamin Roth. Very good read.

Anyway, 1989 was rough,

The FDIC resolved 206 failed banks—a post-Depression record tied to the 1980s banking and S&L crises.

Recent years it’s been pretty quiet…

Five in 2023.

March 10: Silicon Valley Bank, CA ($209 billion)

March 12: Signature Bank, NY ($110.4 billion)

May 1: First Republic Bank, CA ($229.1 billion)

July 28: Heartland Tri-State Bank, KS ($139 million)

November 3: Citizens Bank, IA ($66 million)

Two in 2024.

April 26: Republic First Bank, PA ($6 billion)

October 18: First National Bank of Lindsay, OK ($107.8 million)

And two in 2025.

January 17: Pulaski Savings Bank, PA ($49.5 million)

June 27: Santa Anna National Bank, TX ($63.8 million

Surprisingly, bank failures are fairly uncommon.

Yet The Market Is Pricing 20%

On Polymarket, my average entry price is about 23¢ per share, so a total stake of 1,000 dollars would pay out roughly 4,439 dollars if the ‘Yes’ side wins, because it includes fills at multiple prices around 20–23¢, not just a single 20¢ order.

I haven’t taken a position. But I might.

The reason is I don’t know how fast banks “fail”, as that’s outside my wheelhouse.

But if I remember correctly, SVB went from functioning to dumpster fire pretty dang fast.

Do you know why the Metropolitan Capital Bank & Trust closed?

Because regulators deemed it “unsafe and unsound”.

It’s capital was “impaired” – in plain terms, it was no longer safely solvent.

But the real reason it became “impaired” was a long‑running problem loan tied to a 4.5 million dollar exposure to a Chicago real estate investor involved in a Ponzi‑scheme case; the loan was repeatedly modified, poorly collateralized, and ultimately left the bank with limited recourse.

For a bank with only about 261 million dollars in assets, that single problem credit was a large concentration and contributed to regulators’ earlier consent order in 2019 for “unsafe and unsound conditions,” tightening capital and lending standards.

The reason I bring that up is because you know what else acts like a pseudo Ponzi-scheme, over leveraging, ruining everything it touches, and financially engineers itself into a never-ending black hole?

Private equity and private credit.

And the banks are on the hook.

Private credit has exploded to over $4 trillion in recent years.

Sure, it sits outside the traditional banking system, but it’s deeply intertwined with it.

Large banks have loaned roughly $300 billion directly to private credit and private equity funds—credit lines, term loans, repo agreements, total return swaps. Global estimates from the IMF and OECD put total bank exposure to hedge funds, private credit, and other non-bank financial institutions at around $4.5 trillion, roughly 9% of banks' loan books in the US and Europe.

But if you’d paid attention lately, AI is destroying the collateral.

Private credit became a major lender to software buyouts just as AI began compressing the value of "legacy" software.

But now, deal flow is plummeting, revenue is weakening, exit markets are freezing…

When private credit continent to suffer losses or face redemptions, they default on bank credit lines, trigger margin calls, or force fire-sales into markets where banks are also exposed.

Except it’s already happening!

In November 2025, Blue Owl moved to limit withdrawals from one of its funds—a redemption freeze signaling the fund couldn't meet withdrawals without fire-selling assets.

That was three months ago.

Recently Blue Owl Capital is down 13%, Ares Management, KKR, and TPG each fell by double digits too. Apollo and Blackstone dropped as much as 8%. Bloomberg ran the headline: "Private Capital Titans Rush to Defend Software Companies as AI Rout Deepens."

I’m not calling for another great depression, a crisis, or financial armageddon.

We’re just asking the question, how many banks have exposure to $300 billion in bank loans to private credit funds sitting on top of $4 trillion in private credit exposure backed by software collateral that AI is annihilating?

In other words, how many banks are exposed to this? Who’s next?

There are roughly 4,400 FDIC-insured institutions in the U.S.

We know the largest banks have $322 billion in credit commitments to private credit and PE firms.

But we don't have a bank-by-bank breakdown. We don't know which regional banks are exposed. We don't know where the next concentration risk sits.

Metropolitan Capital was small and isolated. The next one might not be.

To be clear: I’m not rooting for a bank failure. Bank closures mean job losses, disrupted communities, and real economic pain.

But prediction markets aren't about what we want to happen, they're about what might happen. and the point of this newsletter is to see if there’s a trade in here somewhere, and why.

We have until March 31st to see.

Polymarket has run multiple "will a bank fail this year" markets.

Whether it becomes a monthly standing event or fades away who knows.

I think a lot of it depends on what happens next in private credit and private equity.

Have a great weekend everybody.

Don’t Miss These Events!

___________________________________________________________________

DISCLAIMER:

The Content is not intended to provide, and does not constitute, financial, investment, trading, tax, legal, or any other form of professional advice. It is not a recommendation, suggestion, solicitation, or offer to buy, sell, trade, or hold any securities, event contracts, derivatives, cryptocurrencies, or other financial instruments on platforms such as Polymarket, Kalshi, or any other prediction market.

Prediction Market Edge believes the Content is reliable but makes no representations or warranties as to its accuracy, completeness, timeliness, or suitability for any purpose. The Content is subject to change without notice, and Prediction Market Edge assumes no duty or obligation to update it.

Trading in prediction markets involves significant risk of loss, including the potential loss of your entire investment. Past performance (including any highlighted “wins” or gains) is not indicative of future results. Markets are volatile, influenced by news, liquidity, resolution rules, and other factors, and individual results will vary. Subscribers and readers should conduct their own independent research, consider their financial situation, risk tolerance, and objectives, and consult qualified professionals before making any trading or investment decisions.

Prediction Market Edge is not responsible for any third-party information, market data, platform rules, or services referenced herein, including but not limited to Polymarket, Kalshi, or other exchanges. Use of the Content is at your own risk.

By subscribing to or accessing this Newsletter or related materials, you agree that Prediction Market Edge and its affiliates shall not be liable for any direct, indirect, incidental, consequential, or other damages arising from your use of the Content.

For important additional information, please review our full Terms of Service, Privacy Policy, and any Subscription Agreement (available on predictionmarketedge.com).