Tesla reports Q4 2025 earnings today, January 28, 2026 after market close.

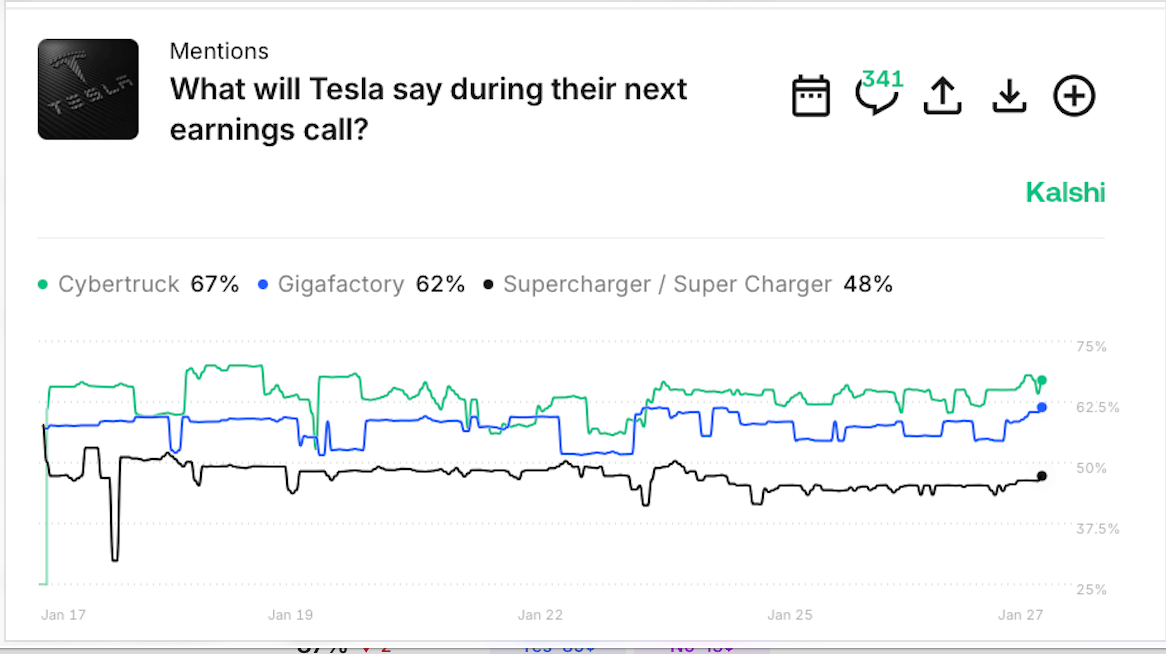

While prediction markets are pricing "Robotaxi" at 99%, "FSD" at 98%, and "DOGE" at 9%, I analyzed three consecutive quarters of Tesla's earnings transcripts word-by-word to see what Elon Musk and his team might actually talk about during the call.

The results weren’t too surprising except for the fact that Q1 2025 ran 86 minutes (longest of the year). Thanks to DOGE and tariff panic (44 mentions), and pre-launch Robotaxi hype.

Q2 collapsed to just 59 minutes as operations normalized, DOGE mentions vanished (15→0 mentions), and tariff mentions faded (44→15 mentions).

Sidebar: (If they faded that much, then what does that mean should we expect today?)

Q3 bounced back to 66 minutes…

Anyway, I expect Q4 to run 56-61 minutes. Of course there’s not a market for call length. (Not yet at least).

Let’s look at the SuperMeter…

The Mention SuperMeter

Instead of relying on just one earnings call, the Mention SuperMeter reveals potential predictable patterns in corporate communication by analyzing multiple quarters, and in no specific order.

Individual call breakdown - mentions per quarter

Total mentions - across all 3 calls combined

Average per call - to identify consistent patterns

Heat rating - visual indicator of frequency (🔥🔥🔥🔥🔥 = very hot/frequently mentioned)

Look at how many of Tesla key words were mentioned in the last 3 earnings calls.

What do you notice? Anything stand out?

What The SuperMeter Indicates About Q4 2025

The Seemingly Absolute Locks: 95%+ Probability

Robotaxi could be mentioned at least 10 times.

The pattern from previous quarters has been, 19→16→7 (declining as service matures post-launch). Even so, service now live in Austin + Bay Area, expanding to 8-10 metros by year-end.

This is THE growth story.

I can see Elon citing expansion metrics, safety stats, economics.

No wonder Kalshi is pricing is at 99% YES. ✅

FSD / Full Self Driving could be mentioned roughly 12 times. Sure, the patterns have been 28→22→14 (declining, but still dominant)

Over the last three months we’ve seen the version 14 rollout, Hardware 3 support, adoption rates closing in on 12% of the fleet.

It’s a major revenue driver ($99/month subscriptions), safety validation (10x safer claim).

No wonder Kalshi is pricing it at 98% YES. ✅

Optimus is another banger. 10+ mentions is my guess. They had a massive quarter. Massive 36 mention in Q3.

Elon's "Friday night Optimus meetings go till midnight." This is his obsession.

No wonder Kalshi is pricing: 97% YES. ✅ (should be 99%+ IMO)

Energy: I mean C’mon. at 98%? Solid Q4 context: Megapack 4 plans, record deployments, AI/data center demand…

For TSLA it’s a recurring business segment, always discussed, and a strong 98% YES makes sense. ✅

The Likely Yet Cautious Mentions

Autonomous shrank in mentions— 34→17→9 (declining as branding shifts to "Robotaxi") Yet still sitting at 96% YES . ⚠️ SLIGHTLY OVERPRICED IMO.

Battery has seen collapsing mentions: 17→3→ 2

Kalshi is pricing it at 96% YES. ⚠️ OVERPRICED (should be 75-85%) But hey.

TEXTBOOK CRISIS ARC Tariff/Tariffs mentions fell from 44→15→6 ←

Q1 it had what, a $400 million impact?

Either way, things seemed to settle.

But at 77% (as of last night) it might be worth revisiting.

China is sitting at 95%. That’s seems normal.

The Coinflips: Watch out!

Regulator/Regulatory/Regulation…

These have been getting a handful of mentions on prior calls so I can see it happening again. (No wonder they’re priced high.)

Pattern: 8→8→5 (consistent compliance discussion)

Context: Robotaxi city approvals (Nevada, Florida, Arizona), Europe/China FSD

Kalshi pricing: 95% YES ⚠️ OVERPRICED

Delivery/Deliveries: 5+ mention is my guess (not sure why these aren’t 95%+)

Pattern: 12→8→7 (routine operational metric)

Context: Q4 typically strongest quarter, record deliveries expected

Kalshi pricing: 91% YES ⚠️ UNDERPRICED

Grok 5 was sitting at 28% last night. Seems like a Cinderella mention. The Ppattern has been growing: 1→3→5 ⬆️ (xAI integration increasing in voice recognition for Optimus, AI comparison discussions..)

✅ I like this one, not because I use Grok. or Grok 5. (and the rules are they have to say “Grok 5”. Just “Grok” won’t cut it.

But because of pricing.

It looked like a good buy.

Until I asked Grok…

After much deliberation, here’s what it said. Might have to zoom in to read it.

If you can’t zoom, here’s the text:

“Yeah, I'd say 28% feels meaningfully low—borderline pessimistic—if you're bullish on the AI/xAI narrative being a big part of Tesla's story. Here's why it might be underpriced (i.e., the true odds could be higher):

Historical precedent for Grok/xAI mentions: Elon Musk and execs (like Ashok Elluswamy or even Lars Moravy) have name-dropped "Grok" in recent calls, even if briefly. In Q3 2025, Grok got a direct shoutout when Elon contrasted it with Tesla's in-car AI (calling Grok a "giant beast" too big for cars but highlighting synergies). Grok integrations (e.g., voice commands in 2025.26+ updates, holiday features like Grok Santa Mode) have been teased or confirmed in software releases. "Grok 5" specifically? It's the next big leap—Musk has hyped it as potentially AGI-level (6T+ params, native video/reasoning), with a Q1 2026-ish drop per his late-2025 comments. If the call touches on AI compute ramps, Optimus brains, FSD reasoning upgrades, or xAI-Tesla ties (e.g., Megapacks powering Colossus), a casual "Grok 5" reference is plausible. Past calls often veer into forward-looking AI hype when Q&A gets philosophical or when Elon goes off-script—happens more than people expect.

Call dynamics boost the odds: Earnings calls last 45-90+ minutes, with extended Q&A where Elon fields wildcards. Questions on Say (Tesla's platform) often push AI/robotaxi/Optimus, and voters prioritize those. If any get traction (e.g., "How will Grok advancements feed into Tesla AI?"), Elon loves flexing xAI wins. Even a passing "we're excited for Grok 5" or "Grok 5-level reasoning coming to FSD" counts. Broader sentiment on X today shows bulls betting on an "upbeat Elon" post-pay-package vibe, which historically means more visionary tangents (not just dry numbers on deliveries/energy misses).

Why the market might be pricing it too low (under 28%):

Tesla's core narrative today is vehicle/energy/robotaxi execution amid EV slowdowns (deliveries down ~16% in Q4, full-year dip). Analysts expect focus on margins, Cybercab timelines, energy records (14+ GWh deployed), and FSD metrics—not deep xAI dives.

Grok 5 isn't shipping yet (still "in pipeline"), so it could stay high-level or avoided to manage expectations.

But if undervalued at 28%, real odds could be 40-55% in my view—factoring in Elon's tendency to hype upcoming models, cross-company synergies (Tesla powers xAI, Grok enhances Tesla experiences), and how calls often surprise on AI enthusiasm when numbers are meh.”

So yea, AI is taking over.

If Grok is right, and “Grok 5” is mentioned today, that’s going to make this newsletter way more interesting in the days ahead.

Regardless, 28% seems decently priced for TSLA’s AI integrated future.

You know, I almost hope Grok is wrong because then I’ll be less fearful of what AI is capable of. But let’s not kid ourselves.

Good luck today.

Don’t Miss These Events!

___________________________________________________________________

DISCLAIMER:

The Content is not intended to provide, and does not constitute, financial, investment, trading, tax, legal, or any other form of professional advice. It is not a recommendation, suggestion, solicitation, or offer to buy, sell, trade, or hold any securities, event contracts, derivatives, cryptocurrencies, or other financial instruments on platforms such as Polymarket, Kalshi, or any other prediction market.

Prediction Market Edge believes the Content is reliable but makes no representations or warranties as to its accuracy, completeness, timeliness, or suitability for any purpose. The Content is subject to change without notice, and Prediction Market Edge assumes no duty or obligation to update it.

Trading in prediction markets involves significant risk of loss, including the potential loss of your entire investment. Past performance (including any highlighted “wins” or gains) is not indicative of future results. Markets are volatile, influenced by news, liquidity, resolution rules, and other factors, and individual results will vary. Subscribers and readers should conduct their own independent research, consider their financial situation, risk tolerance, and objectives, and consult qualified professionals before making any trading or investment decisions.

Prediction Market Edge is not responsible for any third-party information, market data, platform rules, or services referenced herein, including but not limited to Polymarket, Kalshi, or other exchanges. Use of the Content is at your own risk.

By subscribing to or accessing this Newsletter or related materials, you agree that Prediction Market Edge and its affiliates shall not be liable for any direct, indirect, incidental, consequential, or other damages arising from your use of the Content.

For important additional information, please review our full Terms of Service, Privacy Policy, and any Subscription Agreement (available on predictionmarketedge.com)